FEATURED QUESTION : LOAN PROCESS

Q: What is the expected timeline for the receipt of my funds?

ANSWER

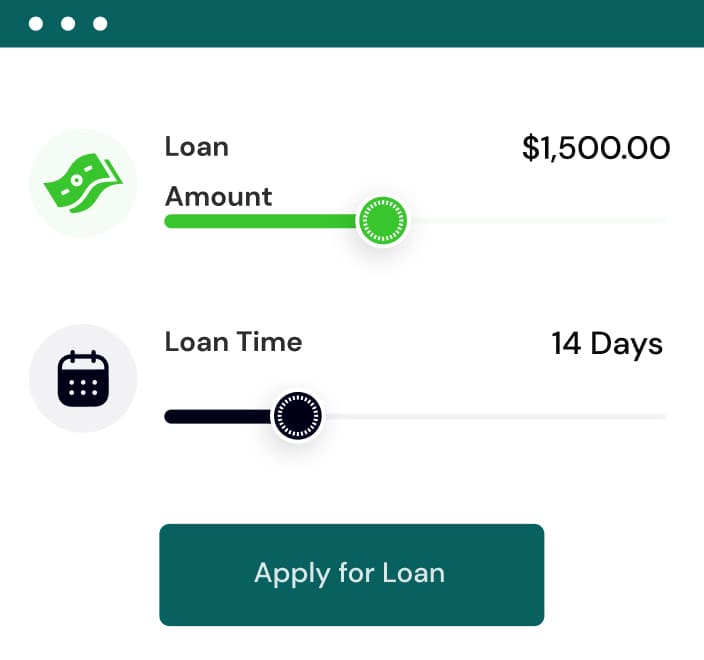

The timeframe for receiving approved funding is influenced by various factors. Each lending partner follows their unique approval processes, resulting in different funding timelines.

Typically, the funding process can range from as quick as 24 hours to up to 1 week.

Rest assured that we work diligently to expedite the funding process and strive to provide you with the capital you need in a timely manner.

Loan Types

A line of credit is a flexible credit option that offers a predetermined capital limit and allows for on-demand access as needed. Unlike a conventional term loan, you have the freedom to access all or a portion of the credit line up to the predetermined limit at any time. Interest is only incurred on the amount utilized, providing cost savings. For further information on a business line of credit, we invite you to explore our comprehensive resource, the Business Owners’ Guide to a Business Line of Credit.

Factoring is a financing option that differs from a traditional loan as it involves the purchase of future receivables. In this arrangement, a third party, referred to as a factor, buys a company’s invoices or purchase orders at a discounted rate. This enables business owners to gain upfront access to a portion of the invoice or purchase order value, rather than waiting for payment. Once the factor collects the payment, the remaining balance, after deducting the agreed-upon fees or discount, is paid to the business owner.

For instance, let’s consider an invoice worth $10,000. By utilizing a factor, you could receive a percentage upfront, such as $8,000, while the factor keeps a fee, let’s say 6%. When the invoice is eventually paid, you would receive the remaining amount, minus the factor’s fee. In this example, the transaction would be $8,000 received today, plus $2,000 (the remaining balance), with a deduction of $600 (the factor fee), resulting in accessing the capital now instead of waiting for the full payment later.

Please refer to our comprehensive resource, the Business Owners’ Guide to Factoring, for more information on this financing approach.

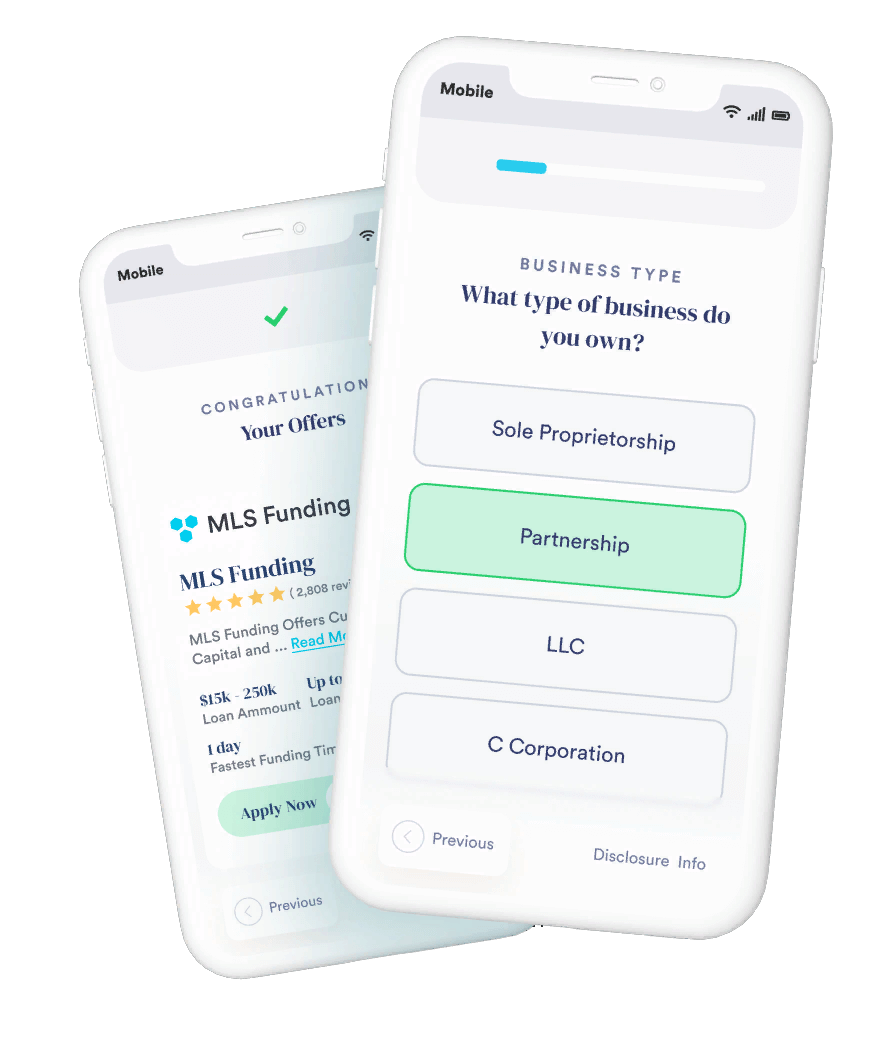

Applying

While having a bankruptcy in your past may present challenges, it doesn’t automatically disqualify you from obtaining a small business loan. However, it is important to note that different lenders have varying requirements when it comes to lending to individuals with a bankruptcy history. Typically, it is unlikely for a borrower to qualify for a loan within the first year after the bankruptcy. Most lenders will expect to see a minimum of one year of improved credit history following the resolution of the bankruptcy. This demonstrates a borrower’s commitment to rebuilding their creditworthiness and financial stability. It’s advisable to work on improving your credit history and demonstrating responsible financial behavior during this period to enhance your chances of securing a small business loan.

Collateral refers to the assets that a borrower can offer as security for a loan. In the event that the borrower defaults on the loan, the lender has the right to take possession of the specified asset or assets to recover the outstanding loan amount. Collateral serves as a form of protection for the lender, reducing the risk associated with lending funds. It provides assurance that the lender has recourse to recover their investment in case of non-payment. To gain a deeper understanding of collateral and its significance, we recommend referring to our comprehensive resource, the Business Owners’ Guide to Term Loans.

Lenders often require a personal guarantee from the business owner(s) as a common practice to safeguard themselves in the event of a loan default. This guarantee acts as a form of protection for the lender when extending loans to small businesses. Typically, lenders consider the personal guarantee as a prerequisite before offering a loan. It allows the lender to have additional options to pursue debt collection in case of default. By obtaining a personal guarantee, the lender can mitigate the risk associated with lending to small businesses and enhance the likelihood of recovering the outstanding debt.

The requirement for a business plan largely depends on the type of loan you are seeking. When applying for an SBA loan, a business plan is typically necessary. However, other lenders may not explicitly demand a formal business plan but will still inquire about the purpose of the loan and how it will contribute to improving profitability or other aspects of your business. Regardless of whether a lender explicitly requires a business plan, it is advisable to go through the process of creating one. This exercise will enable you to articulate your loan objectives and clearly communicate the anticipated benefits you expect to gain from the capital infusion. Having a well-prepared business plan demonstrates your preparedness and strengthens your loan application.

A business loan is a specialized form of financing tailored to meet the financial needs of businesses. It serves as a valuable resource to support various aspects of business operations, such as funding day-to-day activities, covering payroll expenses, acquiring necessary equipment, and capitalizing on expansion opportunities. By providing access to capital, business loans empower entrepreneurs and organizations to manage and grow their ventures effectively. Whether it’s maintaining cash flow, investing in essential resources, or seizing strategic opportunities, a business loan can play a crucial role in fueling business success.

When applying for a business loan, lenders typically consider several factors to assess your eligibility. These factors commonly include your credit score, the length of time your business has been operating, and your business bank statements, which provide insights into your cash flow. These criteria help lenders evaluate your creditworthiness, repayment ability, and financial stability. Additionally, depending on the specific lender and loan program, they may require additional information and documentation during the underwriting process. This could involve providing details about your business’s financial statements, tax returns, business plan, collateral, or other relevant documents. By thoroughly assessing these factors, lenders can make informed decisions about approving and structuring the business loan that aligns with your unique needs and financial circumstances.

Loan Process

The personal credit score indicates an individual’s repayment track record for personal loans, mortgages, and other financial obligations. It is typically represented on a scale of 300 to 850, with higher scores indicating better creditworthiness. On the other hand, a business credit profile reflects how well a business owner fulfills their financial obligations related to the business. While there isn’t a universal business credit score, various credit bureaus evaluate different business behaviors to assess creditworthiness. The three primary personal credit bureaus are Experian, Equifax, and TransUnion, while the three main business credit bureaus are Dunn & Bradstreet, Experian, and Equifax. Discover more about business and personal credit in our comprehensive guides: Business Owners’ Guide to Business Credit and Business Owner’s Guide to Personal Credit.

READY TO GET STARTED?

View Your Options