Access the necessary funds to fuel your business's expansion and success.

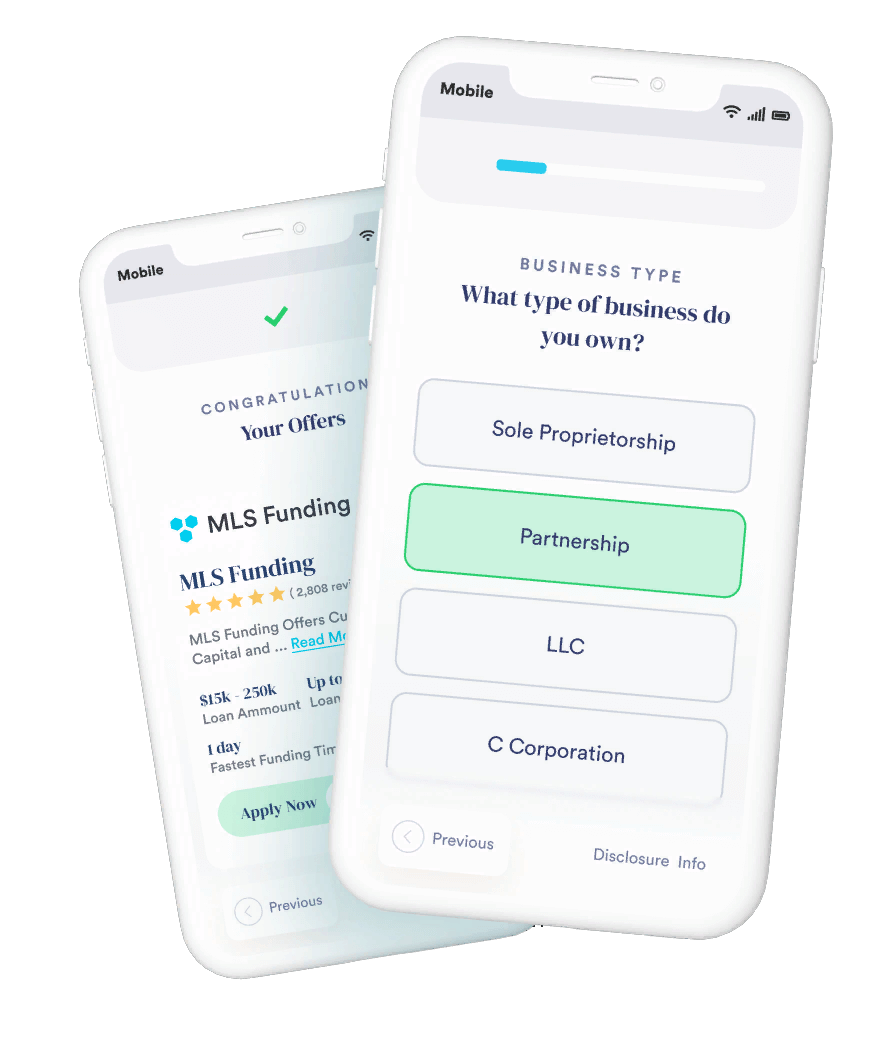

Seamlessly assess and compare multiple loan options simultaneously, enabling you to confidently select the perfect fit for your specific needs.

The Process

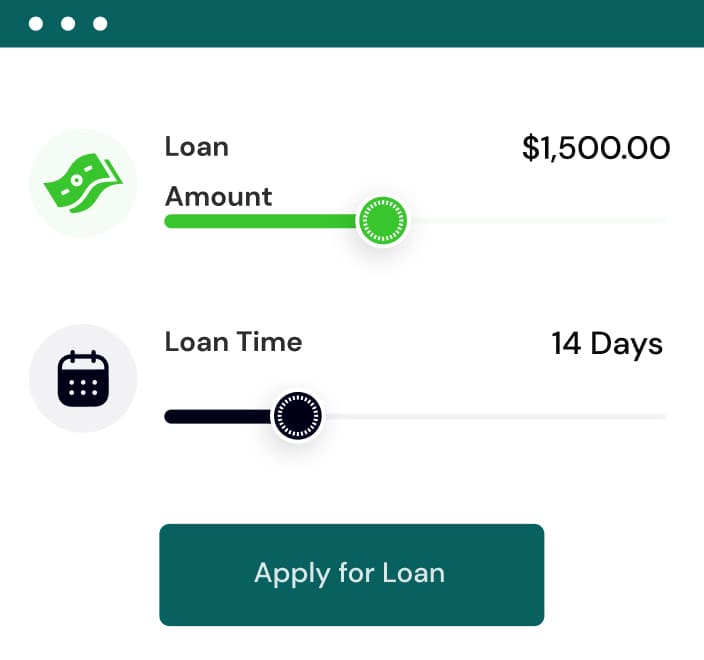

Take control of your financial decisions and gain peace of mind with our quick and hassle-free process.

Answer a series of basic questions in under 3 minutes, all while knowing that your credit score remains unaffected. In the driver’s seat, you have the power to compare multiple offers and choose the one that best suits your needs.

Empower yourself with confidence and convenience, all at your fingertips.

What We Do

Leveraging our advanced proprietary technology, we swiftly evaluate your business information and seamlessly connect you with the perfect lending partners. Our extensive network of carefully selected lending professionals is at your disposal, ready to assist in fulfilling your capital requirements.

Short Term Loan

Long Term Loan

When contemplating a significant investment or seeking expansion opportunities, it is wise to explore the advantages of a long-term loan. With terms typically spanning from 5 to 10 years, and in some cases extending beyond 20 years, these loans provide the necessary financial support. Long-term loans can offer either fixed or floating interest rates, giving you the flexibility to choose the option that aligns best with your needs.

Line of Credit

Merchant Cash Advance

Why we are the best?

Loan terms are agreed to by each party before any money is advanced.

A loan may be secured by collateral such as a mortgage or it may be unsecured.

Cutting-Edge Technology

Extensive Network of Experts

Diverse Loan Options

Choose from a range of loan types that cater to your unique financial needs. Whether it’s a short-term loan for immediate working capital, a long-term loan for significant investments, or a flexible line of credit that adapts to your cash flow, we provide diverse options to suit your business requirements.

We make 10K+ smile, see what they are saying

Loan terms are agreed to by each party before any money is advanced.

A loan may be secured by collateral such as a mortgage or it may be unsecured.

Ralph Edwards

Benjamin Anderson

Alexander Collins